Table of Contents

What is Digit Trading?

Learn how to binary trade digits on the Synthetic indices with the Binary.com/Deriv binary options trading platform. Digits are a type of fast trade where you can predict the last digit of the price and earn money. Deriv offers three kinds of digit trades: Matches or Differs, Even or Odds & Over or Under.

Prefer to watch the video version?

Binary Trading Ticks

For binary trading digit trades, you can choose a tick size from 1 – 10.

Matches or Differs

Step 1: Choose any digit from 0 to 9.

Step 2: Choose a tick ranging between 5 to 10.

Step 3: Choose either match or differ.

Example:

If you choose digit 5 and tick 5, and the ‘match’ option, then on the 5th tick, highlighted digit by the Deriv must be 5 for you to win. If you choose the ‘differ’ option, then on the 5th tick, highlighted digit by the Deriv must NOT be 5 for you to win.

‘Matches’ trade type always gives the highest return up to 800%, whereas Differs gives between 6% – 20%.

Warning: Digit Trading is pure gambling. Your capital is at risk. Please trade responsibly.

Binary Options – Deriv – Digits Match/Differ trade

Binary Options – Deriv – Digits Match/Differ trade

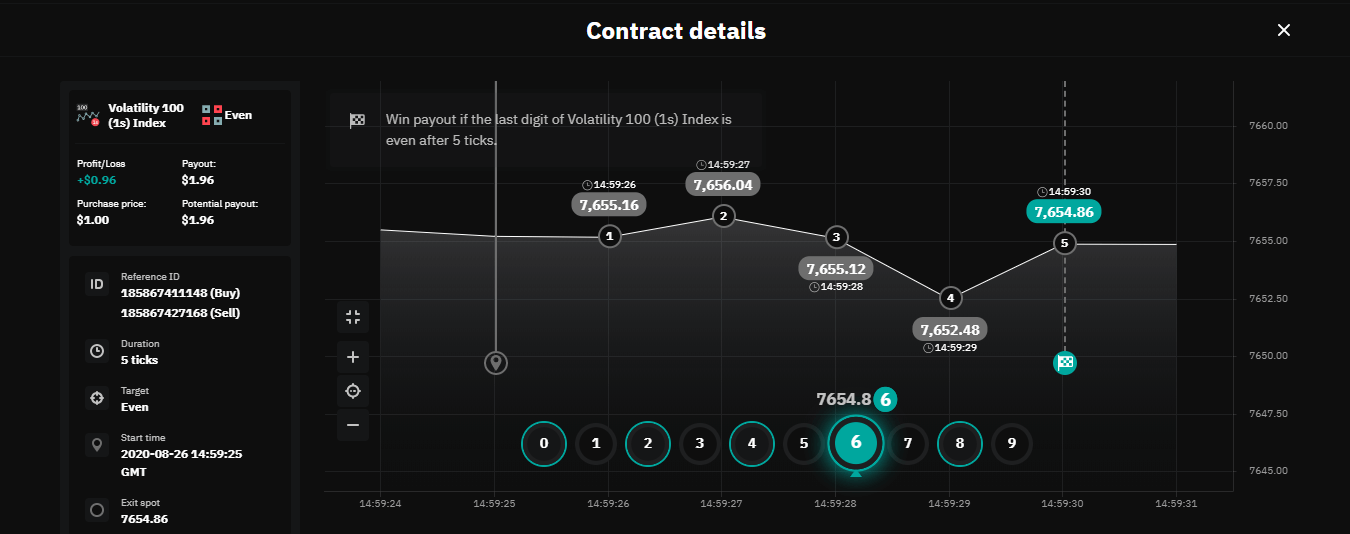

Even or Odd

Step 1: Choose a tick ranging between 5 to 10.

Step 2: Choose either even or odd.

In this type of trade, you can choose to bet on either Even or Odd digits.

Example:

If you choose tick 6 and the ‘even’ option, then on the 6th tick, highlighted digit by the Deriv must be even for you to win. If you choose the ‘odd’ option, then on the 6th tick, highlighted digit by the Deriv must be odd for you to win.

Over or Under

Step 1: Choose any digit from 0 to 9.

Step 2: Choose a tick ranging between 5 to 10.

Step 3: Choose either over or under.

Example:

If you choose digit 3 and tick 7, and the ‘over’ option, then on the 7th tick, highlighted digit by the Deriv must be over 3, i.e., any number above 3 for you to win. If you choose the ‘under’ option, then on the 7th tick, highlighted digit by the Deriv must be under 3, i.e., any number below 3 for you to win.

Digit Statistics

Learn how to use the tick data feature for the digits 0-9. You can choose different tick intervals to see the frequency of each digit as the last one in that interval. This will help you analyze the patterns of the numbers in the tick data.

Strategy for Digit Matches

For Trading Matches, you need to pick those numbers which occurred maximum time on the last 25 ticks & also in the previous 100 ticks.

Example:

As an illustration, if for 25 ticks ‘0’ came out 12% time, and for 100 ticks 15% time. Then you have 12-15% chances to win the digit matching trade with ‘0’. Next is to configure your money management based on that.

Strategy for Digit Differs

Digit difference is the opposite of digit matching. It has a lower payout but a higher chance of winning. For example, if you choose ‘0’ in the previous example, the probability of getting “0” is only 12-15%. This means, if you play digit difference with ‘0’, you have an 85% chance of winning.

Money Management

A crucial aspect of this strategy is money management. For instance, consider the digit match and differ option, where digit match pays 800% and differ pays around 10-20%. This means you need to win at least 90% of the time to make a profit.

Example:

For example, if you wager $1 for 10 times, and win 9 times, your profit will be only 0.8 cents.

The same principle applies to the rising and falling types of trade. With odd or even binary options trade, you can earn a 90% return in both scenarios.

Trade the above strategy with Deriv

Get Free Crypto E-Book

Disclaimer: Deriv offers complex derivatives, such as options and contracts for difference (“CFDs”). These products may not be suitable for all clients, and trading them puts you at risk. Please make sure that you understand the following risks before trading Deriv products: a) you may lose some or all of the money you invest in the trade, b) if your trade involves currency conversion, exchange rates will affect your profit and loss. You should never trade with borrowed money or with money that you cannot afford to lose.

Disclaimer:

The content of this article is purely educational purpose does not give any trading advice to Buy or sell securities. All investing and trading in the securities market involve risk. IntraQuotes disclaims any liability for any damages or losses that may arise from using the information in this article. Traders are solely responsible for their own decisions and actions when choosing and trading with any broker. IntraQuotes disclaims any liability for any damages or losses that may arise from using the information in this content.

LOGIN WITH GOOGLE

LOGIN WITH GOOGLE