What is Binary Options Trading?

Binary options revolve around the theory of ‘all or nothing’, either you can earn a great percentage of profit on your investment or you can lose all of it, within a certain time limit.

Table of Contents

Understanding Binary Options Trading

Strike Price

The price at which trade will commence or the rate at which binary options holder can place put call trades on any securities.

Put and Call Option

In Downtrend sell side is a put option, and in the uptrend buy side is a call option.

Expiration

The time when the trade will get closed.

Binary options trading involves predicting the future price movement of any asset, such as stocks, commodities, or currencies, within a given timeframe. The trader must decide whether the asset’s price will rise or fall from its current value at the time of the trade.

For instance, let’s consider stock ABC, currently trading at $56.00. You predict that it will reach $60.00 within the next 3 hours. To capitalize on this prediction, you place a trade on the buy-side call option with a strike price of $60 and a 90% return rate. If your prediction is correct and the stock reaches $60 or higher within the specified time frame, you will earn $90 on your initial investment of $100.

On the other hand, if the stock fails to reach $60 within the given time, you will incur a loss of only $100 from your initial investment. This aspect of binary options trading makes it attractive to some traders since the maximum risk is limited. For instance, on a $5000 account, the maximum loss you could experience on any trade would be $100, regardless of how much the ABC stock moves or experiences a remarkable decline.

For instance, let’s consider stock ABC, currently trading at $56.00. You predict that it will reach $60.00 within the next 3 hours. To capitalize on this prediction, you place a trade on the buy-side call option with a strike price of $60 and a 90% return rate. If your prediction is correct and the stock reaches $60 or higher within the specified time frame, you will earn $90 on your initial investment of $100.

On the other hand, if the stock fails to reach $60 within the given time, you will incur a loss of only $100 from your initial investment. This aspect of binary options trading makes it attractive to some traders since the maximum risk is limited. For instance, on a $5000 account, the maximum loss you could experience on any trade would be $100, regardless of how much the ABC stock moves or experiences a remarkable decline.

Ad Space Available

Ad Space Available

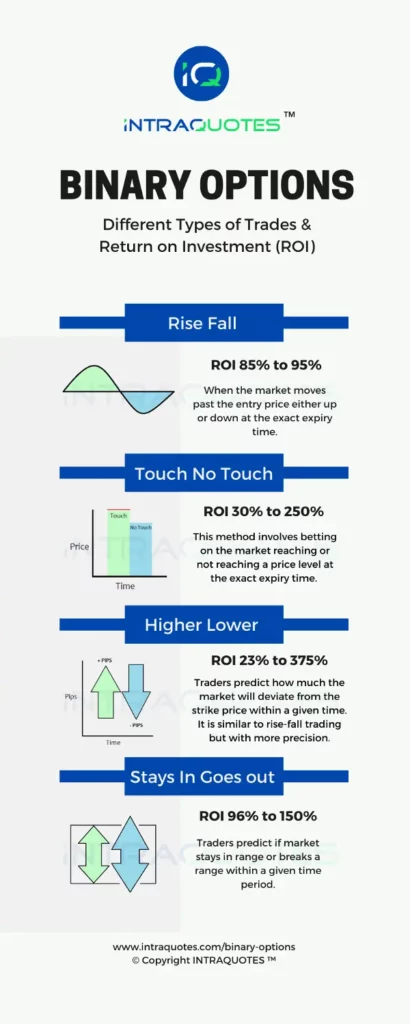

Binary Options Trade Variation

High Low

High-low binary options trading is a type of trading system that does not depend on the exact strike price. Instead, it only requires the market to move above or below the entry price at the expiry time.

Example

Suppose a trader enters a high-low trade on ABC stock at $56, expecting it to rise. If the stock reaches $58 at the expiry time, the trader will win the trade, because the ending price is higher than the starting price. Even if it’s higher than $2 or 2 pips (in the case of forex), you will still earn profits.

Touch No-Touch Trade

In this method, traders place bets on whether the market will reach a certain price level before the binary options trade expiration time.

Example

Building upon the previous example, a trader might wager that the ABC stock price will either touch $60 or not touch $60 within the next 3 hours. This type of binary options trading is well-suited for range-bound markets or during range breakout scenarios.

Higher Lower Trade

This variation closely resembles high-low binary options trading, with the difference being that traders must place bets on how much higher or lower the market will move from the strike price.

Example:

Following the first example, if the strike price is $56, a trader can bet that after 3 hours, the market will go $5 higher than the strike price. This implies that before the expiration time, the stock price needs to reach $56 + $5 = $61 to win the trade.

Stays In or Goes Outside

This method bears similarities to the touch-no-touch type of binary options trading, but here, traders place bets on whether the ABC stock price will remain within a specific price band or move outside of it.

Example:

For instance, a trader can set a price range of $50 to $60 for ABC stocks. After the 3-hour expiration time, the ABC stock will either stay inside the $50 to $60 range or move outside of it.

These different types of binary options trading offer traders various ways to speculate on the price movements of underlying assets, allowing for diverse trading strategies based on market conditions and risk appetite.

LOGIN WITH GOOGLE

LOGIN WITH GOOGLE